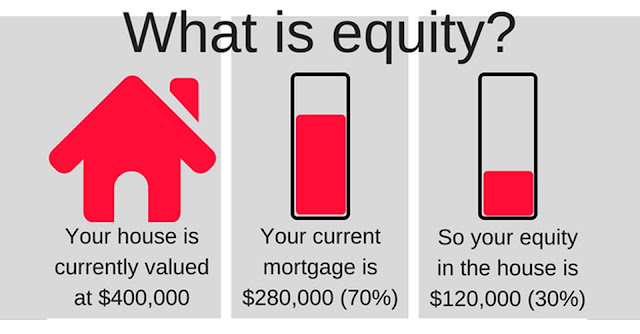

Home equity refers to the part of your private home's fee which you certainly very own. It is the distinction among the market value of your own home and the great stability in your mortgage or every other liens in opposition to the assets. In less complicated phrases, it represents the amount of the home that you personal outright, without any debt.

Right here's how home equity works:

1. Constructing domestic fairness: when you first of all purchase a domestic, your equity is generally equal on your down fee. As you're making loan payments over the years, your fairness will increase. Moreover, if your private home appreciates in cost, your fairness can also grow.

2. Home fairness Calculation: To calculate your own home equity, subtract the amazing stability to your loan and every other money owed secured with the aid of your property from the contemporary market fee of your home. For example, if your house is valued at $three hundred,000 and also you owe $2 hundred,000 for your mortgage, your equity would be $a hundred,000.

3. Utilizing domestic equity: homeowners can get entry to their domestic fairness thru numerous techniques, together with:

A. Domestic fairness Loans: those are loans that allow you to borrow towards the fairness in your house. The lender offers you with a lump sum, and you repay it with interest over a fixed term. The hobby charges are generally fixed, and the loan is secured by means of your private home.

B. Domestic fairness strains of credit (HELOC): A HELOC is a revolving line of credit that lets in you to borrow against your home fairness as wanted. Just like a credit card, you've got a credit restriction, and you could borrow and pay off more than one times throughout the draw length. Hobby prices are generally variable.

C. Coins-Out Refinance: With a coins-out refinance, you refinance your current loan for a higher quantity than you owe and acquire the difference in cash. For instance, if your house is really worth $300,000 and also you owe $200,000, you may refinance for $250,000 and get hold of $50,000 in coins. Then you definately have a new mortgage with a higher stability.

4. Benefits of domestic fairness: home fairness can offer numerous benefits, consisting of:

A. Get entry to to price range: by using tapping into your own home fairness, you may use the funds for various functions, such as domestic enhancements, debt consolidation, schooling expenses, or emergencies.

B. Decrease interest rates: home fairness loans and HELOCs frequently have decrease interest fees as compared to different forms of borrowing, inclusive of private loans or credit cards. This is due to the fact the loan is secured through your home.

C. Capacity Tax blessings: In some cases, the hobby paid on a domestic equity mortgage or HELOC can be tax-deductible. However, it is critical to discuss with a tax expert for particular info and eligibility.

5. Risks and concerns: it's vital to bear in mind the dangers related to the use of domestic fairness. Considering the fact that your home serves as collateral, if you're not able to repay the loan, you can probably face foreclosures. Additionally, borrowing against your property fairness reduces the amount of ownership you have got in your home.

Keep in mind, domestic fairness isn't always the same as liquid coins, as you need to borrow in opposition to it or promote the property to access its fee. It is really helpful to cautiously compare your monetary scenario, goals, and the phrases and conditions of any mortgage or line of credit earlier than leveraging your home fairness.

DISCLAIMER: The information contained on this website about mortgage/insurance is for general informational purposes only. It is not intended to be a substitute for professional advice or an endorsement of any particular insurance product or company. Individuals should consult with licensed mortgage/insurance professionals to assess their specific needs and consider appropriate coverage options. We do not assume any liability for decisions made based on the information provided on this website.